JP Morgan Chase, the world’s largest bank by market capitalisation, bought Sri Lankan start-up WealthOS for an undisclosed sum on Tuesday, according to documents seen by The Examiner.

The deal, a buyout of all existing shareholders, is larger than the London Stock Exchange Group’s purchase of MillenniumIT, a source familiar with the transaction said. The London Stock Exchange Group bought MilleniumIT for $30 million in 2009. Other than investors — including Barclays and Singapore-Lankan VC fund nVentures — 27 Sri Lankan and three UK-based WealthOS staff will cash-in.

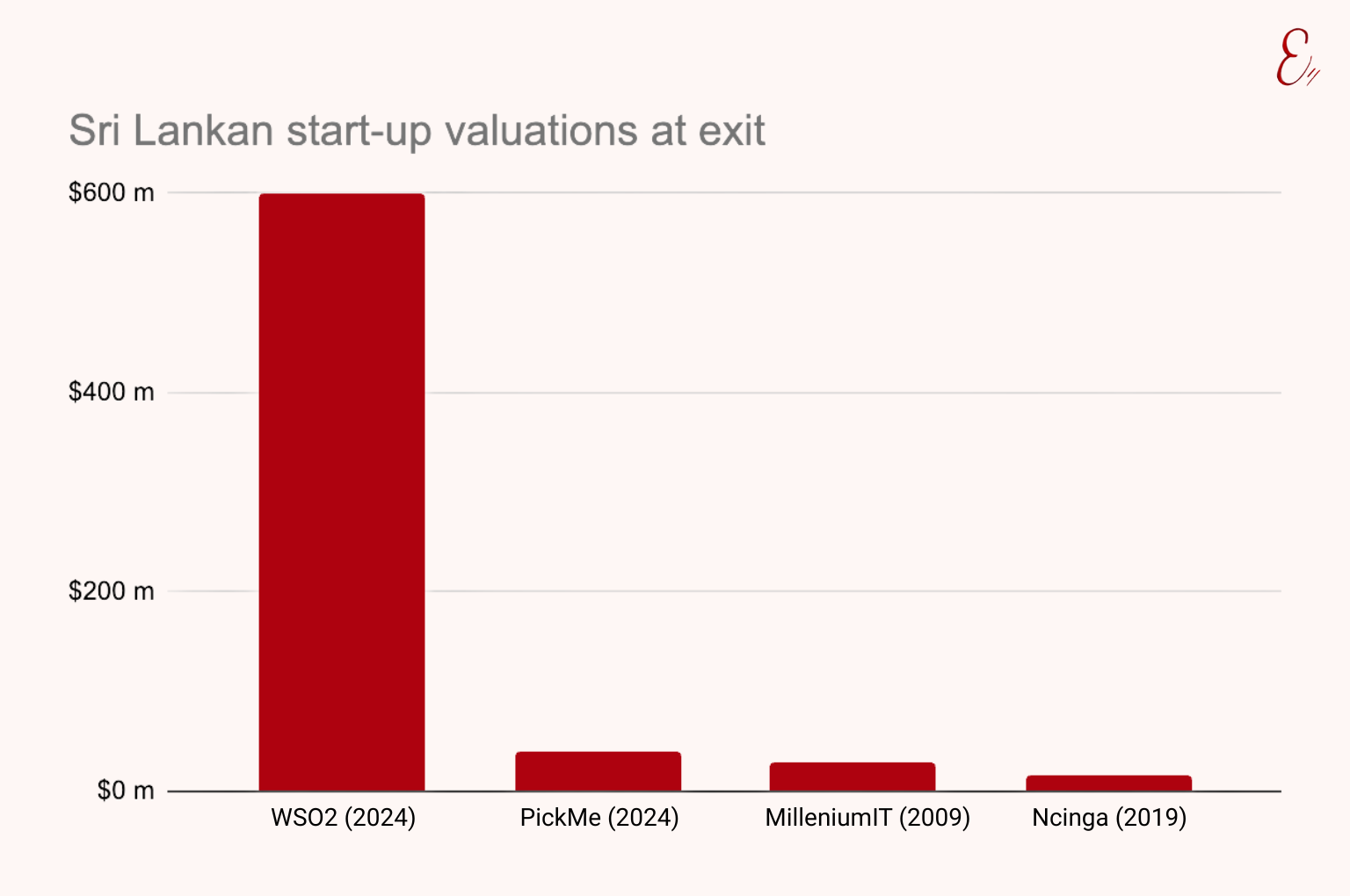

The acquisition will be the fourth major exit by a Sri Lankan tech startup. Other than MillenniumIT, the others are WSO2, PickMe, and Ncinga. It is also the fastest major exit as WealthOS, incorporated in the UK, was founded by Anton Padmasiri and Chamat Arambewela in late 2019. Securing its first client in 2023, it now employs over fifty people in Sri Lanka and four in the UK.

WealthOS provides the behind-the-scenes systems that digital wealth managers rely on to run their businesses, leaving the wealth management firms to handle the customer-facing side of their business. It was the first company in the UK to launch cloud-native software for self-invested personal pensions.